Phoenix’s divergence suggests more resilient local fundamentals—migration, job growth, and supply constraints. Nationally, median home prices were down ~0.6 % and pending sales were collapsing ~31 %, indicating broader weakness. The relative strength tempers downside risk in Phoenix-centric holdings. From tax revenue projections, this resilience helps sustain municipal forecasts. Policymakers may point to this in justifying infrastructure or housing policy. For value stability, the local cushion provides greater breathing room than many other U.S. markets.

Phoenix’s industrial real estate pipeline stood at 11.9 million sq ft under construction in mid‑2025, down from ~28 M SF in Q2 2024, with 2.4 M SF of net absorption YTD and 11.3 M SF leased.

Institutional investors are focused on high‑clear‑height, build‑to‑suit industrial assets, which offer tax‑beneficial asset depreciation. Planning and zoning updates have enabled flexible build‑to‑suit deliveries. Diversified tenant mix and occupancy rates underpin future asset value retention. Logistics designs include sustainable materials and site planning aligned with emissions reduction.

In early 2025, infrastructure development at Halo Vista began delivering auto mall, office, industrial, and retail parcels. Investors tracking zoned commercial land in emerging corridors anticipate capital appreciation.

The project uses standardized public‑land auction mechanisms for tax transparency. Regulatory approvals facilitate cohesive buildout. Value stability is reinforced by long‑gestation master‑planning. Smart‑city design principles include multimodal corridors and energy‑efficient services.

A $7 billion Halo Vista mixed‑use community is advancing in north Phoenix around TSMC’s semiconductor campus, projected to comprise ~30 million sq ft of industrial, residential, educational, hospitality and R&D space, and generate ~10,000 permanent jobs plus 80,000 regional jobs. Wealth‑management portfolios tied to industrial and mixed‑use property stand to gain from diversified income streams.

Tax base expansion is supported via public‑private planning under Arizona’s State Land Department policies. From a regulatory lens, master‑planned zoning and infrastructure investment ensure long‑term resilience. The scale supports future‑proof capital through integrated residential and employment buffers, while sustainability is embedded through efficient land use and infrastructure planning.

With Maricopa County’s Proposition 479 tax extension approved in November 2024, ADOT is now acquiring right‑of‑way and preparing for 2027–2035 construction of the SR 30 central segment from Loop 202 to 97th Avenue. The full 29‑mile corridor through Buckeye, Goodyear, Avondale and Phoenix will relieve I‑10 corridor congestion and unlock west valley development.

For real‑estate portfolios, corridor access typically translates to increased land values. Tax revenues from new development are anticipated. The project operates under established transportation legislation and county tax frameworks. Infrastructure expansion secures future‑proof transit corridors, while freeway design reflects sustainability via optimized routing and reduced vehicular emissions on arterial congestion.

Arizona Department of Transportation has completed the 11‑mile I‑10 Broadway Curve widening project on May 31, 2025, adding HOV lanes, collector‑distributor roads, new bridges (including 48th Street and Broadway Road), improved interchanges and multi‑use pedestrian bridges near Sky Harbor Airport. This infrastructure upgrade supports faster logistics, commuter flow and airport access, improving the attractiveness of nearby industrial and hotel sites.

Tax‑base impact includes potential rise in commercial property assessment values. Project followed voter‑approved Proposition 400 planning and state funding authorizations. Long‑term value retention is enhanced via mobility improvements, and multiuse bridges support smart‑city objectives of walkability and reduced congestion emissions.

The former Metrocenter Mall site in Phoenix is undergoing repositioning into "The Metropolitan," a $750 million mixed‑use village comprising residential units, retail, medical facilities, senior housing and office space. Demolition began in mid‑2024 following zoning changes initiated in 2016. The light‑rail Metro Parkway station opened in January 2024, enhancing transit access.

For wealth preservation, transit‑oriented assets at the site attract institutional capital and stabilize valuation. Tax increment financing and rezoning provide the regulatory framework. Value stability is supported through mixed‑income housing and medical tenant diversity, while density near rail is aligned with smart-growth and reduced‑vehicle‑carbon strategies.

Phoenix was ranked the top industrial real estate market in Q1 2025 with a score of 67.5, driven by robust ongoing construction and strong absorption metrics. Institutional investors tracking warehouse and logistics demand see opportunities in build‑to‑suit and speculative developments.

Industrial property tax rolls are growing, and incentives like sales‑tax abatements have supported speculative construction. State and local policy continues to favor industrial zoning and infrastructure access. Diversified tenant profiles support future resilience, while industrial development fosters sustainable growth models in goods distribution, utility services, and energy‑efficient design.

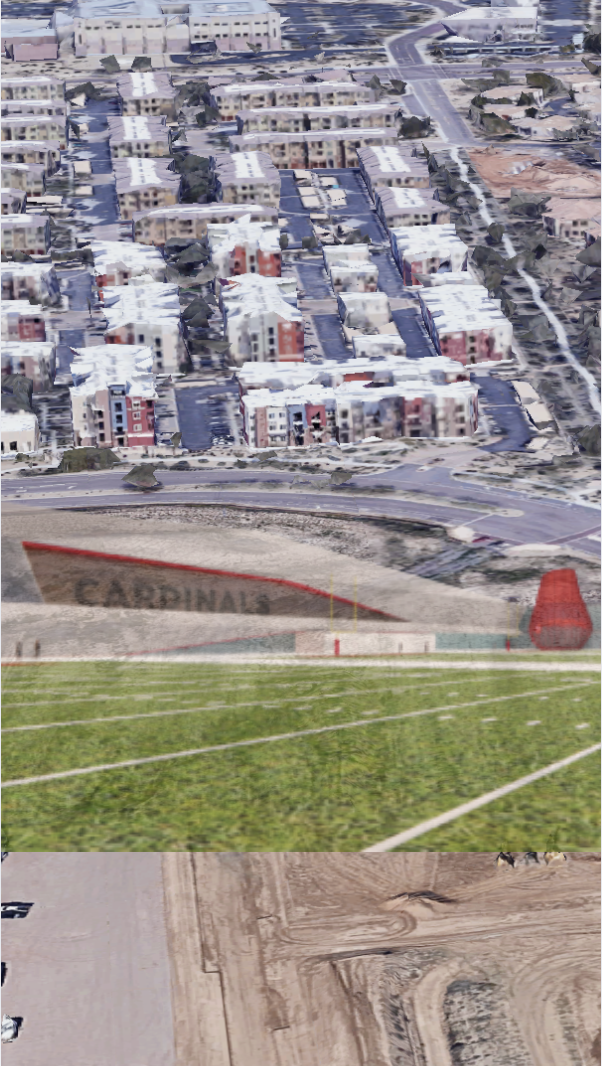

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

How To Invest In Real Estate Using Your IRA Or Old 401(K)Across the Valley, wealth management is taking on a new dimension. With rising property values in North Scottsdale, steady redevelopment in Old Town, and luxury residential projects in Desert Mountain

How To Invest In Real Estate Using Your IRA Or Old 401(K)Across the Valley, wealth management is taking on a new dimension. With rising property values in North Scottsdale, steady redevelopment in Old Town, and luxury residential projects in Desert Mountain Banner Health’s $400 Million Comeback: How North Scottsdale’s New Hospital Could Redefine Arizona’s Medical CorridorWhen a city’s skyline begins to change, it’s rarely just about architecture—it’s about ambition, identity, and the human stories that will fill those new walls. North Scottsdale is once again standing

Banner Health’s $400 Million Comeback: How North Scottsdale’s New Hospital Could Redefine Arizona’s Medical CorridorWhen a city’s skyline begins to change, it’s rarely just about architecture—it’s about ambition, identity, and the human stories that will fill those new walls. North Scottsdale is once again standingNice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.