Recent data from the Phoenix Planning and Development Department shows a 7% year-over-year increase in new single-family building permits issued across the Phoenix metropolitan area as of July 2025, with more than 18,000 permits year-to-date. This surge reflects sustained builder confidence, particularly in communities such as Eastmark (Mesa, DMB Associates), Vistancia (Peoria, Shea Homes), and Asante (Surprise, Lennar), where infrastructure investment is prominent. From a wealth management perspective, increased inventory may temper price escalation, influencing portfolio rebalancing and real estate trust strategies. Arizona’s property tax policy remains favorable for primary residences, although higher supply can moderate assessed value growth. No new restrictive legislation is pending, supporting future-proof stability. Smart-city features—such as solar-ready designs and reclaimed water landscaping—are increasingly standard in these communities.

The luxury market in Phoenix saw a 17% year‑over‑year increase in luxury home listings in Q1 2025, followed by another 15% gain in Q2. For wealth managers, this expansion signals differentiated asset allocation opportunities in high‑end segments, albeit with longer average holding periods. The stable zoning regime and absence of rate hikes have muted tax volatility, while ongoing city parcel rezoning efforts are expanding building opportunity zones. From a sustainability lens, new luxury projects increasingly request green‑certification incentives, bolstering long‑run appeal in upscale resale markets. With this elevated listings baseline, pricing resilience remains intact, supporting future capital preservation.

The $7 billion Halo Vista development in Phoenix, anchored by TSMC manufacturing, will span 30 million sq ft across industrial, office, educational, residential and hospitality uses. Initiated through state land auction and led by Mack Real Estate Group and McCourt Partners, the project is expected to support 10,000 permanent jobs, plus up to 80,000 additional jobs regionally.

Commercial real estate portfolios tied to this megaproject anticipate diverse revenue inflows and asset class diversification. Municipal tax revenues are poised to rise significantly. The development benefits from supportive legislative positioning around critical‑minerals manufacturing and mixed‑use zoning. Infrastructure resilience and mixed‑use density add long‑term capital preservation, while integrated planning supports smart‑city sustainability with walkable, transit‑oriented design.

Taiwan Semiconductor Manufacturing Company announced in July 2025 that it is accelerating production at the second of six fabrication plants planned in North Phoenix, after achieving $30 billion in Q2 2025 revenue, up 44 percent year‑over‑year. Once complete, Arizona will produce 30 percent of TSMC’s most advanced chips. The investment to date totals $165 billion across the U.S., including $100 billion for Arizona specifically.

Institutional portfolios tied to semiconductor supply benefit from increased employment and production density, with local property tax bases supported. Regulatory context includes federal incentives and state economic development programs. The project enhances value stability through high‑barrier‑to‑entry industrial assets and aligns with smart‑manufacturing and sustainability criteria via state‑of‑the‑art fab facilities.

In June 2025 Governor Katie Hobbs signed legislation approving up to $500 million in public funds and $250 million in private investment to upgrade downtown Phoenix’s Chase Field, including roof and HVAC systems improvements. Attendance has reached an average of 31,420 per game, the highest in two decades. The deal authorizes sales‑tax revenue flows over 30 years and prohibits use of funds for luxury upgrades, reflecting legislative controls on subsidies.

From a wealth‑management perspective, the enhanced venue stabilizes downtown property appeal, supports local sales‑tax streams, and reduces relocation risk. Tax considerations include dedicated sales‑tax revenue streams rather than general funds. Infrastructure enhancements drive long‑term value retention, while cooling upgrades align with heat‑resilience and energy‑efficiency goals.

Arizona enacted a law in April 2025 canceling a scheduled 2026 vote that would have challenged Scottsdale’s council-approved rezoning for Axon’s proposed headquarters near Hayden Rd/Loop 101, which includes roughly 1,900 apartments and a hotel within a broader employment-anchored plan, thereby cementing near-term entitlement certainty and reducing political timing risk for the sponsor. For wealth holders, stabilized entitlements reduce delay costs across construction capital stacks. Property-tax bases may broaden as the program phases in. The legislative dimension illustrates state preemption over local referendum risk in limited contexts. Value resilience often tracks mixed-use employment anchors with on-site housing. Smart-city angles include integrated mobility, campus energy efficiency, and district services supporting workforce housing supply.

Paradise Valley’s luxury market closed August 2025 with a $4.15 million median, flat year-over-year, while Scottsdale stood at $1.25 million, with a 2% increase. Contracts in the $3–5 million segment were up 14% year-to-date, underscoring sustained ultra-luxury demand, while new listings priced above $2 million increased 11% compared to the same period last year. These properties represent significant wealth diversification vehicles, though taxable valuations place higher obligations on owners under Maricopa Assessor schedules. Regulatory clarity from SB1181 on listing agreements adds transparency to high-value transactions. Long-term value is reinforced by Scottsdale’s 85% build-out ratio, which restricts future land supply, while sustainability mandates in design review, including energy efficiency and water-smart landscaping, bolster asset resilience against climate stressors.

On June 26, 2025 the Chandler City Council voted to support Intel’s federal application to add additional addresses to its FTZ subzone, with follow-on council agenda materials in July indicating continuation of support actions, reinforcing high-tech industrial expansion and associated job creation. From a wealth lens, FTZ benefits can lower operating costs and strengthen local fab investments. For taxes, capital intensity expands assessed value while FTZ structures manage certain levies; net fiscal impact tends to be positive over time. Regulatory oversight remains active on water, wastewater and air permits. Value stability improves around supplier clusters. Smart-city perspectives emphasize energy, water reuse, and transportation linkages to workforce housing.

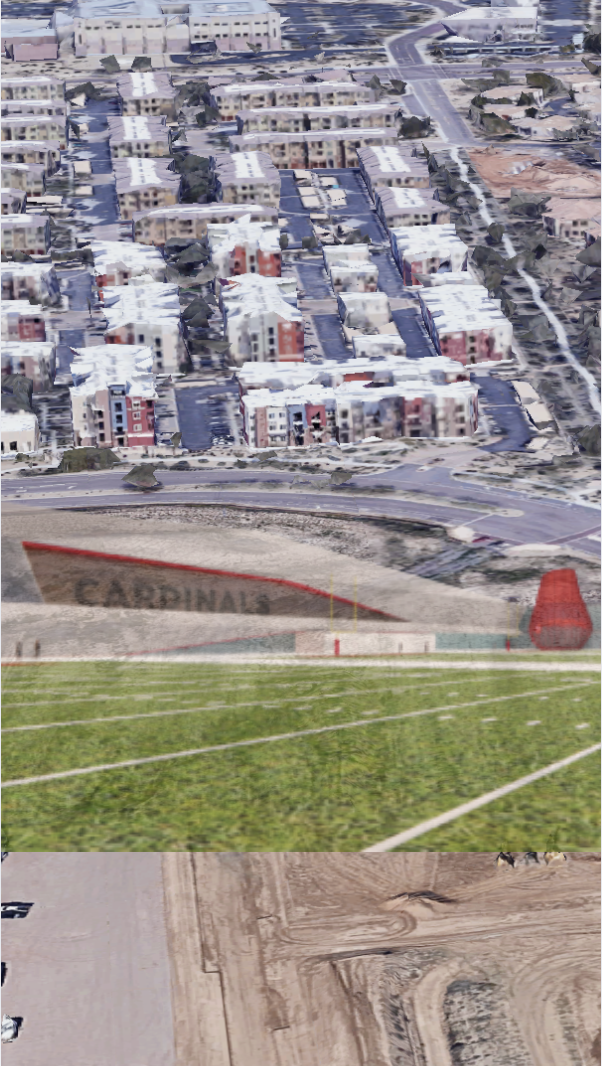

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

The Emerging Landscape: Digital Twins + Efficiency as Value SignalsWithin smart-city discourse and proptech circles, digital twins are evolving from novelty to near necessity. These virtual replicas of physical assets—fed by IoT sensors, performance data, and

The Emerging Landscape: Digital Twins + Efficiency as Value SignalsWithin smart-city discourse and proptech circles, digital twins are evolving from novelty to near necessity. These virtual replicas of physical assets—fed by IoT sensors, performance data, and  Is This Evidence of Deurbanization?Redfin notes about 28 % more single-family sellers than buyers, while condos have 83 % more sellers than buyers

Is This Evidence of Deurbanization?Redfin notes about 28 % more single-family sellers than buyers, while condos have 83 % more sellers than buyers Banner Health’s $400 Million Comeback: How North Scottsdale’s New Hospital Could Redefine Arizona’s Medical CorridorWhen a city’s skyline begins to change, it’s rarely just about architecture—it’s about ambition, identity, and the human stories that will fill those new walls. North Scottsdale is once again standing

Banner Health’s $400 Million Comeback: How North Scottsdale’s New Hospital Could Redefine Arizona’s Medical CorridorWhen a city’s skyline begins to change, it’s rarely just about architecture—it’s about ambition, identity, and the human stories that will fill those new walls. North Scottsdale is once again standingNice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.