Recent data from the Phoenix Planning and Development Department shows a 7% year-over-year increase in new single-family building permits issued across the Phoenix metropolitan area as of July 2025, with more than 18,000 permits year-to-date. This surge reflects sustained builder confidence, particularly in communities such as Eastmark (Mesa, DMB Associates), Vistancia (Peoria, Shea Homes), and Asante (Surprise, Lennar), where infrastructure investment is prominent. From a wealth management perspective, increased inventory may temper price escalation, influencing portfolio rebalancing and real estate trust strategies. Arizona’s property tax policy remains favorable for primary residences, although higher supply can moderate assessed value growth. No new restrictive legislation is pending, supporting future-proof stability. Smart-city features—such as solar-ready designs and reclaimed water landscaping—are increasingly standard in these communities.

Retail investors are actively repositioning small neighborhood centers through re‑tenanting and upgrades, particularly following a 90‑day pause on China tariffs in mid‑2025 that stabilized material costs and consumer confidence.

For diversified RE portfolios, value‑add retail offers opportunistic yield upside. Municipal incentives and sales‑tax abatement tools support repositioning. Repositioned centers often enjoy more balanced tenancy and longer lease durations. Retrofit standards improve energy performance and pedestrian access.

Phoenix’s multifamily segment showed signs of stabilization post‑2018‑2022 market correction, with leveling pricing, strong job in‑migration, and rising rental demand in early 2025.

Investor portfolios benefit from stabilizing yields and diversifying occupancy risk. Rental income fuels property tax base growth. Developers adapt under municipal permitting and material‑cost pressures. Balanced supply and demand points to resilient forward value. Many newer properties include solar-ready infrastructure and water‑efficient landscaping.

National CRE investment totaled $92.5 billion in Q1 2025, up 17 percent year‑over‑year, with Phoenix contributing meaningfully via active industrial, multifamily and retail repositioning projects despite a 12 percent drop in transaction count.

Investors focused on long‑duration cash flows find Phoenix attractive. Tax-relevant transfers incur capital gains and ongoing property assessments. Federal tax policy shifts and zoning changes influence structuring. Diverse asset exposure smooths volatility. Many projects are designed with energy‑efficient materials and transit accessibility.

Scottsdale was ranked second globally for millionaire population growth in May 2025 (14,800 millionaires, +125 percent decade‑over‑decade). Wealth‑management and private capital are flowing into luxury residential, private aviation, bespoke retail and hospitality near Scottsdale Airport.

Tax revenues benefit from high‑value property assessments. City regulations support zoning for upscale districts. Luxury asset demand supports capital stability. Private‑aviation infrastructure aligns with carbon‑offset and energy‑management initiatives.

OrthoArizona announced plans in mid‑2025 to build five new medical facilities and expand five existing operations across Phoenix–Mesa–Tempe, boosting annual patient visits from 674,000 in 2023 to 766,000 in 2024.

For healthcare REIT strategies, expansion signifies durable leasing prospects. Tax base impact extends from building property to local payroll. Projects navigate commercial and medical zoning approvals. Steady patient growth enhances long‑term revenue predictability. Facilities are built with energy‑efficient HVAC and wellness‑design considerations.

Verrado, a New Urbanism master‑planned community in Buckeye, continues its build‑out toward 14,000 dwelling units within its Main Street District, integrating retail, schools, parks and multi‑family buildings in walkable layout.

Residential portfolios focusing on amenity‑rich, lifestyle communities benefit from strong demographic tailwinds. Tax revenues on rising residential density are supported by structured HOAs and school districts. Zoning supports mixed‑use and transit‑ready corridors. Portfolio value stabilized via community‑scale planning. Urban infill and shared infrastructure support sustainability metrics.

Howard Hughes Corporation started development of Teravalis (formerly Douglas Ranch) in October 2022, with lot sales initiated in 2024. At full build‑out, it is expected to include up to 100,000 homes, serve 300,000 residents, and deliver 55 million sq ft of commercial space on 33,800 acres west of Phoenix.

Mass‑residential development offers scale for institutional residential portfolios. The project is structured under Arizona water‑law compliance and master‑planning regulatory constraints. Infrastructure phasing supports long‑term value capture. Sustainability planning includes water‑rights strategies and clustered density.

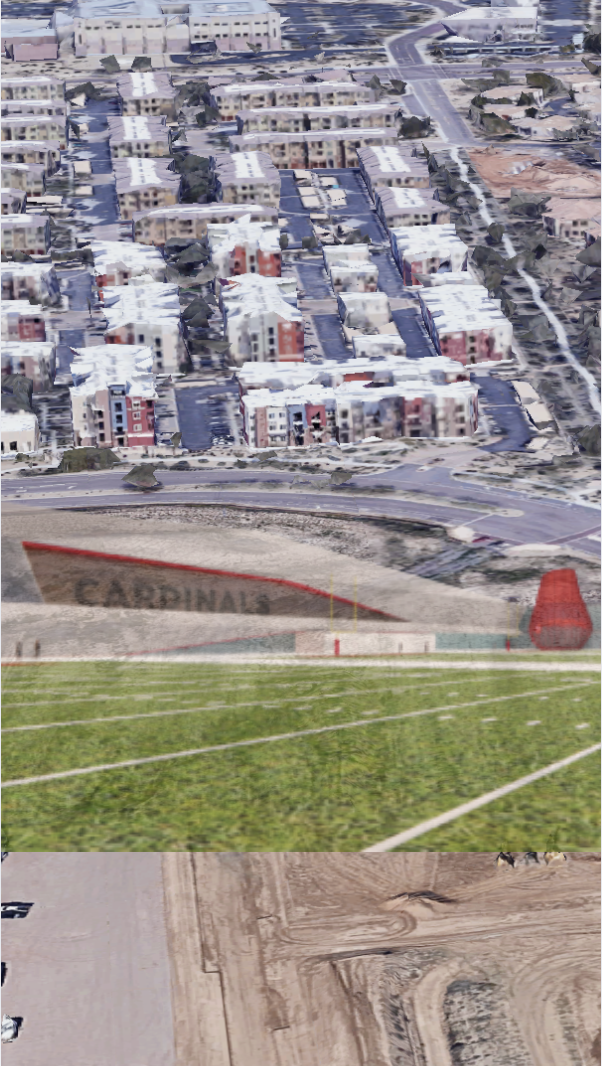

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

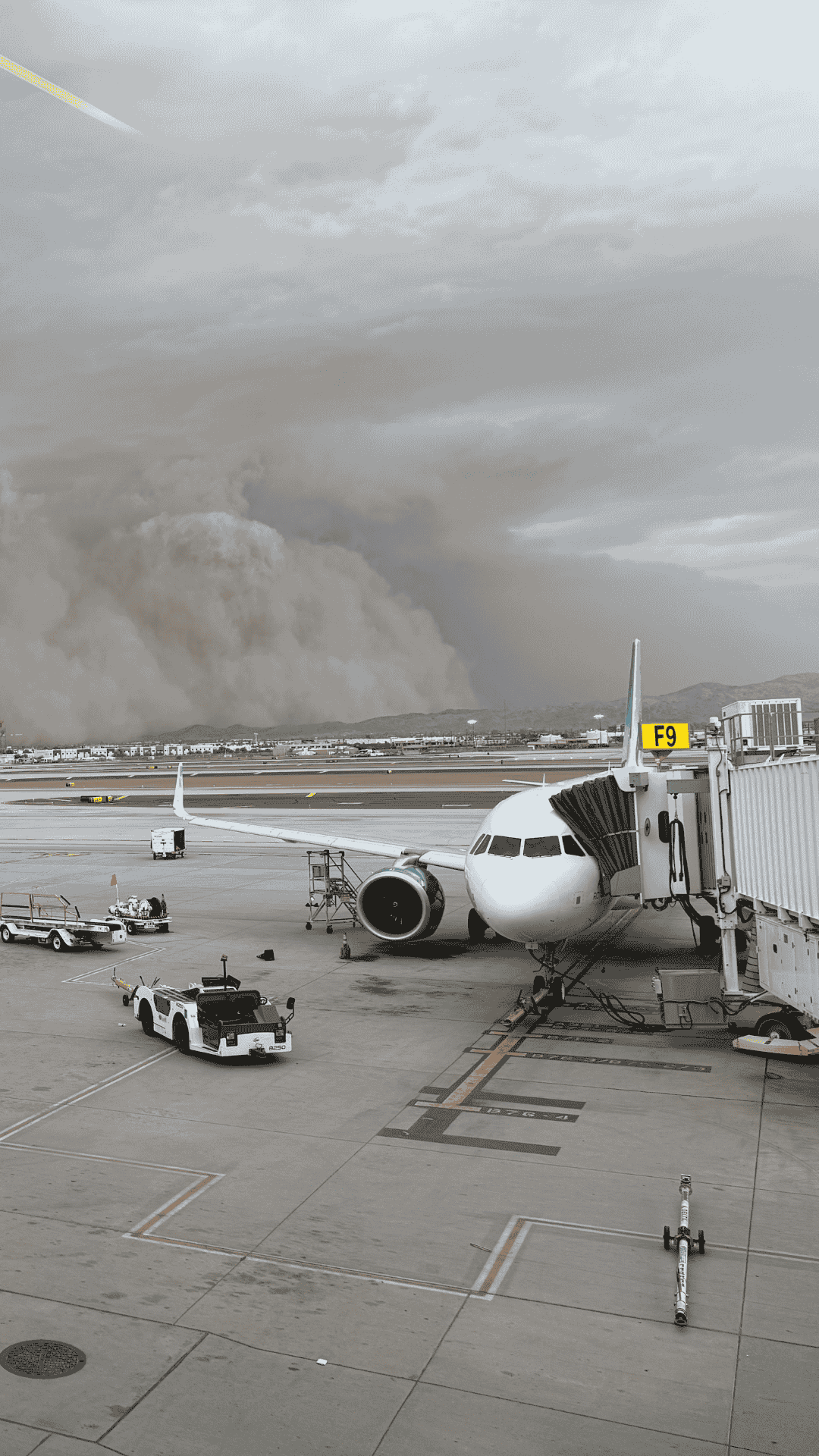

A Force of Nature: Dust Storms and Monsoon Dynamics in PhoenixThis year’s North American Monsoon—officially running from June 15 to September 30—has brought a powerful return of nature’s desert drama to Phoenix, blending relief and disruption in

A Force of Nature: Dust Storms and Monsoon Dynamics in PhoenixThis year’s North American Monsoon—officially running from June 15 to September 30—has brought a powerful return of nature’s desert drama to Phoenix, blending relief and disruption in Nice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.