India’s Smart Cities Mission, running from 2015 to 2025, involves US$20+ billion in funding for 100 cities, delivering projects in smart water, transport, and governance. Thousands of initiatives are underway, including sensor-based safety systems. For investors, this mission introduces scalable opportunities in infrastructure-backed wealth preservation. Tax incentives, including exemptions for specific public–private partnerships, make entry more favorable. With privacy policies evolving, data rights remain under active debate. The program’s wide scope positions Indian urban real estate as an enduring value anchor tied to sustainability.

The Mattel Adventure Park in Glendale, adjacent to the VAI Resort, blends immersive attractions tied to brands like Barbie and Hot Wheels. It represents a large experiential, tourism-driven real-estate anchor. Nearby hospitality, retail, entertainment real-estate may see uplift from increased visitation traffic. Local jurisdictions will face infrastructure demands (roads, parking, utilities). From a regulatory angle, permitting and event zoning will be important. In value terms, properties in surrounding districts may see revaluation linked to visitor amenities and foot traffic.

The Valley is seeing many sellers withdraw properties rather than reduce price or continue listing, driven by mismatches between seller expectations and buyer demand. Heat, mortgage rates, and buyer caution all factor. This trend increases illiquidity risk for residential portfolios. From a tax perspective, fewer closed sales slow turnover and thus compress transaction tax revenue. Local governments may respond with incentive or marketing programs. In value terms, homes in prime nodes or strong school districts will better resist these pressures.

The legislation repeals a local referendum on rezoning for Axon’s development, which includes ~1,900 apartments and a hotel on land formerly zoned light industrial. The new law mandates that in cities with populations of 200,000–500,000, developments tied to international business headquarters be permitted, overriding local referenda. This move reduces regulatory uncertainty for that project, and signals a willingness by the state to constrain local voter control over development in special cases. For investors, this may reduce execution risk in similar projects. Tax implications include assured density and associated levy. From a long-term governance perspective, it recalibrates the balance between local autonomy and state-level economic incentives.

Active listings in Phoenix have risen from ~3,706 three months ago to ~4,385 currently, indicating a loosening of supply constraints. Days on market have lengthened (now averaging 100 days vs ~92 earlier). The average sale price has slipped from ~$574,899 to ~$555,934. Months of inventory is ~4.1, suggesting more balance between buyers and sellers. This environment reduces urgency premiums and increases negotiation power for buyers, which may compress returns for sellers and investors. For municipal tax estimates, this may moderate forecasted growth. In spatial terms, properties in newer, less proven corridors face higher downside risk.

According to affordability research, values in Greater Phoenix have fallen nearly 7 % over the cycle, though only ~1.25 % since late 2024. Meanwhile, mortgage rates have climbed (30-year fixed at ~6.82 %) which suppresses buying power. These trends erode equity cushions in leveraged deals, and may challenge debt servicing in marginal deals. From a tax view, lower assessed values may cause compression in property tax revenues. For longer term holdings, careful location selection and cashflow stress testing become more critical.

A new analysis shows that Phoenix developers managed—temporarily—to outpace demographic growth via multifamily construction between 2022 and 2024. But that momentum is already fading, and forecasts suggest population growth will again overtake housing additions by 2026. The short-lived balance eases pressure on pricing, but rising costs and tight credit may prevent a sharp downturn. For portfolio holders, this grants limited downside buffer. On the policy side, it may moderate calls for emergency incentives. In terms of long-term value, locations with strong fundamentals remain safer bets as supply and demand re-equilibrate.

Phoenix’s purchase marks a concrete step in the “Rio Reimagined” program involving Avondale, Buckeye, Mesa, Tempe, Maricopa County, and tribal partners. The acquired parcel (currently occupied by Ace Asphalt) may be cleared for future mixed-use, public space, or waterfront activation—though design plans are pending. The local segment, called RIO PHX, spans 20 miles. The entire plan is projected to unfold over 25 to 40 years. For investors, this signals commitment to long-horizon catalytic infrastructure. From a tax and municipal finance lens, future incremental value gains will factor into special districts or assessments. Regulatory and land-use coordination will be essential across jurisdictions. In a sustainability sense, visioning around water, habitat, mobility, and open space will influence real-estate outcomes.

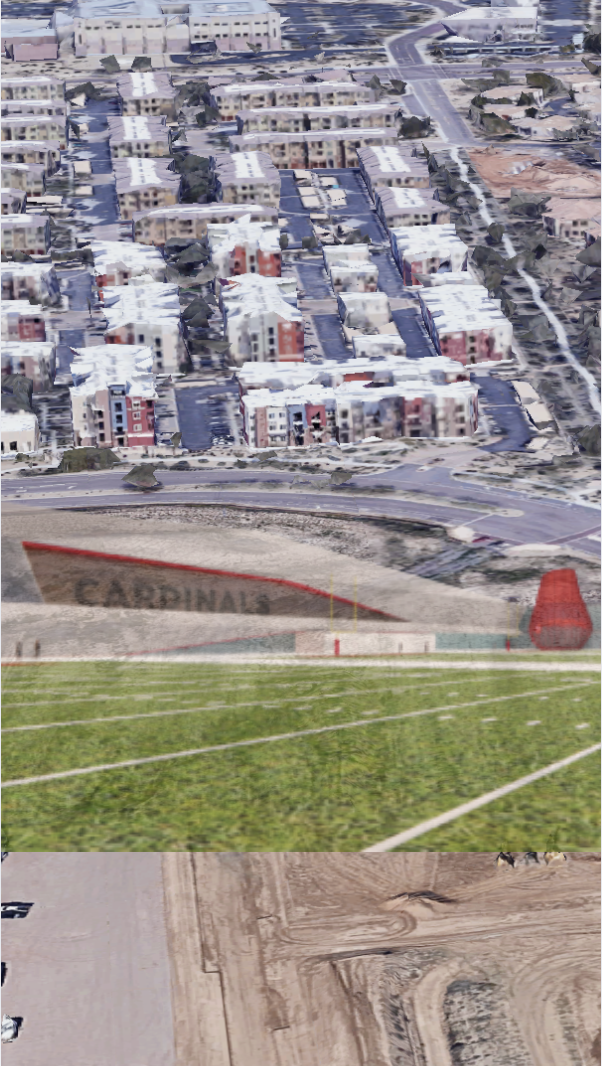

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

The Loop: How Industrial and Mixed-Use Land Acquisitions Are Redefining Phoenix’s Economic CorridorIn the ever-evolving tapestry of Phoenix-area real estate, “The Loop” is emerging as more than just another industrial campus—it represents a frontier of hybrid, high-value land use. In April 2025

The Loop: How Industrial and Mixed-Use Land Acquisitions Are Redefining Phoenix’s Economic CorridorIn the ever-evolving tapestry of Phoenix-area real estate, “The Loop” is emerging as more than just another industrial campus—it represents a frontier of hybrid, high-value land use. In April 2025Nice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.