Chandler has reached 88% build-out capacity, Gilbert 82%, and Mesa 76%, with August 2025 records showing a 7% year-to-date decline in residential building permits. This signals a shift toward strategic infill projects and adaptive reuse, such as Chandler’s repurposing of vacant retail centers into mixed-use hubs. For wealth portfolios, this reduces reliance on raw land appreciation and emphasizes redevelopment premiums. Tax considerations include recalibrated valuations from adaptive reuses that may alter depreciation schedules. Arizona’s HB2110 on accessory dwelling units is expected to influence smaller-lot redevelopment viability. Long-term stability in these cities is supported by job diversity and strong demographic inflows, while smart-city initiatives, such as Gilbert’s expansion of fiber-optic broadband, support sustainable community growth.

The Paradise Valley Mall site, rezoned in 2021 for mixed‑use, will see Phase 1 debuting mid‑2025 with a Whole Foods, apartment buildings, Harkins dine‑in theater, and a central pavilion park.

Mixed‑use investors benefit from combined retail and multifamily yields. Tax flows transition from declining retail to stabilized, broad-based revenue streams. City‑approved rezoning and urban infill planning underpin the project. Blended tenant types increase resilience. Public space and transit‑ready layout support sustainable land use.

Arizona State University’s Tempe District Utility Plant (TDUP), under construction since February 2023, is scheduled for completion by July 2025 and covers ~16,700 sq ft.

As critical infrastructure supporting campus growth, this project affects commercial real estate portfolios tied to university demand. Public‑sector funding is supported by institutional tax‑exempt bonds. Approved through university planning and building codes, the facility enables sustainable district‑wide infrastructure scaling. Utility upgrades stabilize on‑campus asset risk from demand surges. High‑efficiency plant design enhances future resilience and energy‑efficiency metrics.

In May 2025 Phoenix spent $29.5 million to acquire ~30 acres at 7th Street and Rio Salado as part of the 20–40‑year RIO PHX revitalization project covering 20 miles along the river corridor.

Early-stage land acquisition secures future urban redevelopment corridor opportunities for institutional land‑bank investors. Tax increment financing and corridor planning frameworks underpin value growth. The cross‑jurisdictional initiative received intergovernmental approval. Redevelopment preserves asset appreciation through phased activation. Smart‑city objectives include river restoration, green space, and multi-modal linkages.

Phoenix inaugurated the South Central Light Rail (B Line), expanding service from Metro Parkway to Baseline/Central Avenue with eight new stations across 5.5 miles.

Proximity to this transit corridor enhances depth of residential and commercial capital markets. Increased transit‑adjacent tax revenues are anticipated along Central Avenue. Council approvals finalized street reconfiguration and right‑of‑way planning. Transit proximity supports future‑proof value for walkable urban parcels. Smart‑city emphasis is evident in reduced vehicle dependency and aligned TOD planning.

Redevelopment of the iconic 1964 Phoenix Financial Center will transform it into a mixed‑use project, including hotel rooms, residential units, retail amenities, and a grocery store—with construction commencing in 2026 after design approvals.

This repositioning enhances downtown investment-grade density for institutional portfolios. The adaptive reuse conserves property taxes and keeps historic fabric under code compliance. Regulatory permits support preservation while enabling modernization. Mixed‑income tenancy mitigates downside risk. Retained architecture aligns with sustainable building relocation and urban infill goals.

In Q1 2025, Phoenix led the U.S. industrial ranking with a score of 67.5, driven by robust absorption and elevated lease rate growth.

For wealth managers, exposure to industrial REITs or opportunistic developments here offers strong market fundamentals. Property tax revenues continue to grow as valuation bases expand. Zoning policies favor industrial corridor development. Long‑term demand from logistics and high‑tech sectors supports future value and occupancy. Industrial sustainability includes design efficiencies and logistical optimization.

Construction began in January 2025 on two Class‑A industrial buildings totaling ~186,000 sq ft adjacent to I‑17 in Deer Valley, targeting tenants in logistics and semiconductor support supply chains.

Asset portfolios focused on industrial yields benefit from proximity to TSMC and related tenants. Expansion preserves tax revenues via continued site improvements. The project proceeded under industrial zoning with freeway access. Long‑term operational tenants strengthen income continuity. Energy‑efficient fit‑outs and access to workforce‑oriented infrastructure enhance durability.

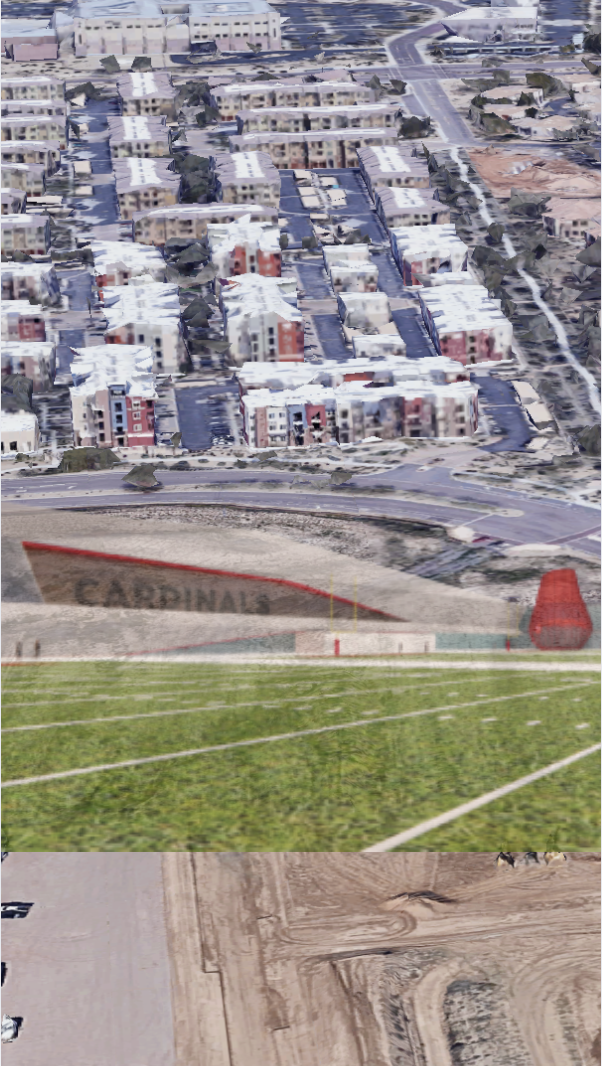

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

A Vision for the River’s ReturnIn the heart of the Arizona desert, water has always been both a lifeline and a rarity. Today, as Phoenix and its sister cities stretch ever wider, a bold idea is gaining traction: to “reimagine” the

A Vision for the River’s ReturnIn the heart of the Arizona desert, water has always been both a lifeline and a rarity. Today, as Phoenix and its sister cities stretch ever wider, a bold idea is gaining traction: to “reimagine” the Nice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.