Recent data from the Phoenix Planning and Development Department shows a 7% year-over-year increase in new single-family building permits issued across the Phoenix metropolitan area as of July 2025, with more than 18,000 permits year-to-date. This surge reflects sustained builder confidence, particularly in communities such as Eastmark (Mesa, DMB Associates), Vistancia (Peoria, Shea Homes), and Asante (Surprise, Lennar), where infrastructure investment is prominent. From a wealth management perspective, increased inventory may temper price escalation, influencing portfolio rebalancing and real estate trust strategies. Arizona’s property tax policy remains favorable for primary residences, although higher supply can moderate assessed value growth. No new restrictive legislation is pending, supporting future-proof stability. Smart-city features—such as solar-ready designs and reclaimed water landscaping—are increasingly standard in these communities.

In the Phoenix region, more home sellers are withdrawing listings than in any other U.S. metro, in part due to pricing mismatches, interest rate headwinds, and buyer caution. That rate of delisting is nearly double the national average. Many homes that remain active also endure longer days on market and more price reductions than in past cycles. For wealth portfolios, this trend suggests heightened liquidity risk in residential holdings. From a regulatory angle, local councils may revisit incentives or “time-to-sale” standards. In terms of long-term positioning, neighborhoods with stronger fundamentals (location, transit access, services) should retain relative value under this pressure.

In April 2025, nearly half of Phoenix’s listings had stagnated, held on the market beyond 60 days without going under contract. Median listing duration in May reached 58 days, exceeding the U.S. average of 50 days. This higher “staleness” reflects slack demand or pricing mismatch. For investors and homeowners, it raises expectations of negotiation room. On the municipal side, slower turnover can dampen property tax growth. From a value stability lens, assets in high-amenity or infill locations are more insulated; peripheral or speculative product is more exposed.

Demolition of the old Metrocenter mall is nearly complete. Construction is slated to begin in April 2026 on three residential communities, with the remaining two phases starting in April 2027. Plans call for 350 apartments (in “Levante”) plus 800–1,000 townhomes, along with retail, event venues, plazas, pedestrian and bike circulation, and landscaped public spaces. This large-scale infill project reflects a shift toward dense, mixed-use redevelopment over traditional retail-only form. In terms of real-estate strategy, it will reshape density, traffic flows, and value corridors in north Phoenix. Zoning changes, infrastructure upgrades, and public realm investments are already being aligned. Sustainability and smart-growth principles are embedded via walkability, transit connections, and mixed function.

Phoenix has recently seen residential development edge ahead of population growth, especially driven by multifamily projects between 2022 and 2024. However, that momentum is already softening, and analysts predict population growth will again outstrip housing supply by 2026. This brief balance offers some breathing room for affordability, but persistent high mortgage rates continue to constrain buyer activity. For investors, such interludes can moderate risk, though structural fundamentals (land availability, infrastructure costs) retain outsized influence. Policymakers may point to this data in legislative debates over housing incentives or zoning flexibility, while sustainability goals must reconcile densification with water and energy constraints.

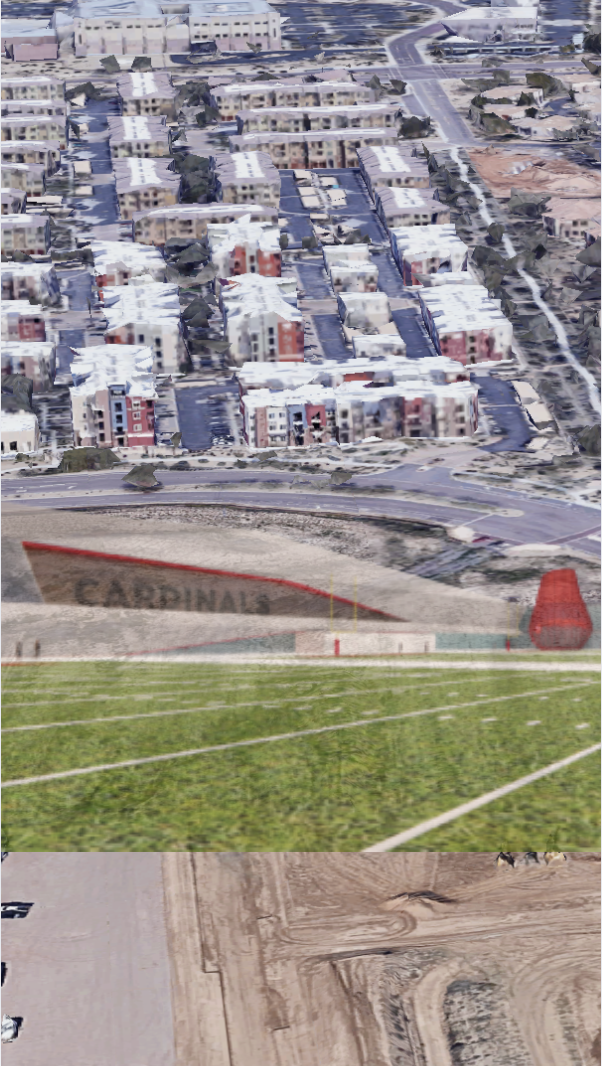

The renovation plan will cover core infrastructure upgrades: air-conditioning, roof systems, structural repairs, and modernization. The financing structure relies on long-term sales tax revenue from stadium-area activity over 30 years. The move aims to keep the team in Phoenix past current lease expiry (2027) and catalyze downtown revitalization. For adjacent real estate, improved amenity, foot traffic, and confidence in permanence may yield spillover benefits. On tax policy, the match-plus-capture model offers one template for anchoring public-private urban assets. In portfolio terms, stakes in nearby blocks may gain relative arbitrage. From a resilience standpoint, modern systems may reduce energy loads and support year-round usage.

Phoenix has recently seen residential development edge ahead of population growth, especially driven by multifamily projects between 2022 and 2024. However, that momentum is already softening, and analysts predict population growth will again outstrip housing supply by 2026. This brief balance offers some breathing room for affordability, but persistent high mortgage rates continue to constrain buyer activity. For investors, such interludes can moderate risk, though structural fundamentals (land availability, infrastructure costs) retain outsized influence. Policymakers may point to this data in legislative debates over housing incentives or zoning flexibility, while sustainability goals must reconcile densification with water and energy constraints.

In the Phoenix region, more home sellers are withdrawing listings than in any other U.S. metro, in part due to pricing mismatches, interest rate headwinds, and buyer caution. That rate of delisting is nearly double the national average. Many homes that remain active also endure longer days on market and more price reductions than in past cycles. For wealth portfolios, this trend suggests heightened liquidity risk in residential holdings. From a regulatory angle, local councils may revisit incentives or “time-to-sale” standards. In terms of long-term positioning, neighborhoods with stronger fundamentals (location, transit access, services) should retain relative value under this pressure.

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Queen Creek: Family-Oriented Growth with a Strategic EdgeQueen Creek continues to stand out as one of Arizona’s most family-centered growth markets, weaving together affordability, quality of life, and long-term community vision. With a median home price

Queen Creek: Family-Oriented Growth with a Strategic EdgeQueen Creek continues to stand out as one of Arizona’s most family-centered growth markets, weaving together affordability, quality of life, and long-term community vision. With a median home price  How To Invest In Real Estate Using Your IRA Or Old 401(K)Across the Valley, wealth management is taking on a new dimension. With rising property values in North Scottsdale, steady redevelopment in Old Town, and luxury residential projects in Desert Mountain

How To Invest In Real Estate Using Your IRA Or Old 401(K)Across the Valley, wealth management is taking on a new dimension. With rising property values in North Scottsdale, steady redevelopment in Old Town, and luxury residential projects in Desert Mountain John Wayne’s Former Arizona Ranch: How a 1,000-Acre Land Sale is Shaping the Future of Maricopa’s Smart GrowthIn late 2025, news broke that nearly 1,000 acres of land once part of John Wayne’s Arizona holdings have been sold to developers. What had been the historic “Red River Ranch” is now being eyed for a

John Wayne’s Former Arizona Ranch: How a 1,000-Acre Land Sale is Shaping the Future of Maricopa’s Smart GrowthIn late 2025, news broke that nearly 1,000 acres of land once part of John Wayne’s Arizona holdings have been sold to developers. What had been the historic “Red River Ranch” is now being eyed for a Nice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.