Olea Scottsdale is being developed north of Loop 101 and east of Scottsdale Road, with careful setbacks (25 ft along main roads, 75 ft for townhouses) and desert landscaping buffers. The project is slated for phased completion through 2027. It targets high amenity, middensity multifamily + attached product in a premium suburban submarket. For real-estate investors, the scale and location may provide yield plus appreciation potential. Local jurisdictions will monitor infrastructure demand (roads, utilities) and traffic impact. The addition helps meet Scottsdale’s multifamily supply needs while aligning with sustainable growth patterns.

In recent legislative sessions and regulatory updates, the Arizona Department of Real Estate has revisited rules around ABAs (where e.g. a brokerage refers to settlement or loan services in which it has interest). Under state law aligned with RESPA’s federal rules, such ABAs must provide clear written disclosures, allow clients to reject referrals, and limit payments to returns on ownership interest, not volume-based compensation. This raises governance expectations for real estate operators and title/settlement firms. In wealth/portfolio terms, it increases compliance costs but reduces hidden revenue leakage. On the tax side, ensuring proper fee structures may interplay with service provider cost allocations. Regulatory oversight is intensifying. For stable value, transparency supports market trust. In broader smart-city or real-estate tech ecosystems, greater disclosure norms may accelerate adoption of transparent fintech platforms.

The city of Phoenix acquired a nearly 30-acre industrial property at 7th Street and the Rio Salado Riverbed for $29.5 million as part of the region-scale Rio Reimagined (RIO PHX) revitalization initiative spanning ~20 miles. The parcel is to be cleared and redeveloped, though specific uses have not yet been finalized. Phoenix’s segment is part of a long-term 25–40 year master plan, with most construction and transformation expected in the first 25 years. For high-net-worth real estate portfolios, this signals a major public land play opening. Tax jurisdictions see a long horizon for incremental revenue uplift. From a regulatory standpoint, multi-jurisdictional coordination (cities, tribal, county) is required. In value terms, adjacency to a reimagined riverfront corridor may drive premium land revaluation. In smart city thinking, this project is an exemplar of comprehensive infrastructure, green spaces, flood control, mobility, and placemaking integration.

The Metrocenter site, long a blighted shopping mall in north Phoenix, is being redeveloped in phases starting April 2026 under the new “The Metropolitan” master plan. Plans include ~350 multifamily units, 800–1,000 townhomes, a mixed-use retail/entertainment promenade (“The Loop”) with amphitheater, rooftop restaurants, plazas, and pedestrian/bike connectivity. This is a high-profile infill reuse that reintroduces density, walkability, and transit linkage. From a wealth and portfolio view, such urban redevelopment can generate outsized upside. Tax-wise, the added parcels increase sales, property, and infrastructure revenue. Regulatory oversight includes zoning and compatibility considerations. In terms of future value, integrated mixed-use with mobility will likely retain appeal under shifting preferences. In smart-city context, the project is a testbed for pedestrian-first, transit-linked, sustainable design.

Under House Bill 2720, property owners in Arizona may build one accessory dwelling unit (ADU) — whether attached, detached, or internal (e.g. garage conversion) — in single-family zones, regardless of prior restrictive local rules. (Gottlieb Law) This legal clarity lifts long-standing uncertainty and opens a modest channel for densification in established neighborhoods. For wealth holders, ADUs can generate ancillary rental income or flexibility. On tax front, added units expand property tax base incrementally. The legislative change may encounter local pushback (e.g. parking, design), but gives developers and local governments a tool for gentle densification. Future proofing: areas with ADU capacity may sustain value better under supply stress. In smart-city terms, ADUs help support transit ridership, reduce sprawl, and increase neighborhood housing diversity.

A recently enacted state law allows underutilized or vacant commercial structures to be converted to residential uses without requiring full zoning changes in many municipalities, streamlining the process for affordable housing reuse. This gives developers a pathway to retrofit office or retail buildings into apartments or mixed use, particularly in infill areas. From a portfolio perspective, this lowers development risk in soft commercial sectors. Tax codes may need adjustment to account for changed building class. The regulatory framework often involves conditional use or overlay zones, but this law reduces rezone friction. In value terms, such conversions may yield premium yield in demand gaps. In smart-city terms, it supports adaptive reuse, reduces vacancy, and embeds housing in existing infrastructure nodes.

With the enactment of HB 2447, municipalities in Arizona must allow certain development approvals (e.g. plat, plan, subdivisions, zoning amendments) to be approved administratively rather than through full elected body review, provided internal checks are met. (rpmphoenixvalley.com) The goal is to remove political delay, cut approval cycles, and reduce uncertainty for developers. As a consequence, projects whose risk stemmed from council calendar bottlenecks may now proceed faster. For holders of capital in real estate, this reduces soft cost risk and improves timing certainty. Tax jurisdictions benefit from more predictable revenue flows. From the regulatory side, statutory guardrails require transparency and appeal mechanisms. Regarding value stability, developments that respond quickly to market demand are likely to perform better. In smart-city design, reducing procedural friction enables more agile deployment of sustainable and smart infrastructure in new neighborhoods.

According to Realtor.com analysis, although total supply across Arizona (including Phoenix metro) remains roughly 16 % below pre-pandemic normal levels, the pace of new listings is increasing, and sellers are adopting more creative pricing to stimulate demand. Rising inventory, together with softer demand, is gradually shifting toward a more neutral balance. As buyers gain leverage, listing strategies (e.g. concessions, incentives) are becoming more frequent. From a wealth management view, selection is expanding, creating more opportunities. Tax assessments may moderate incremental increases. Regulatory bodies may respond with incentive policy shifts. In value stability terms, markets with tight but improving inventory are less exposed to collapse. Smart-city implications: districts that already invested in amenity infrastructure (transit, walkability, EV) may absorb supply with less volatility.

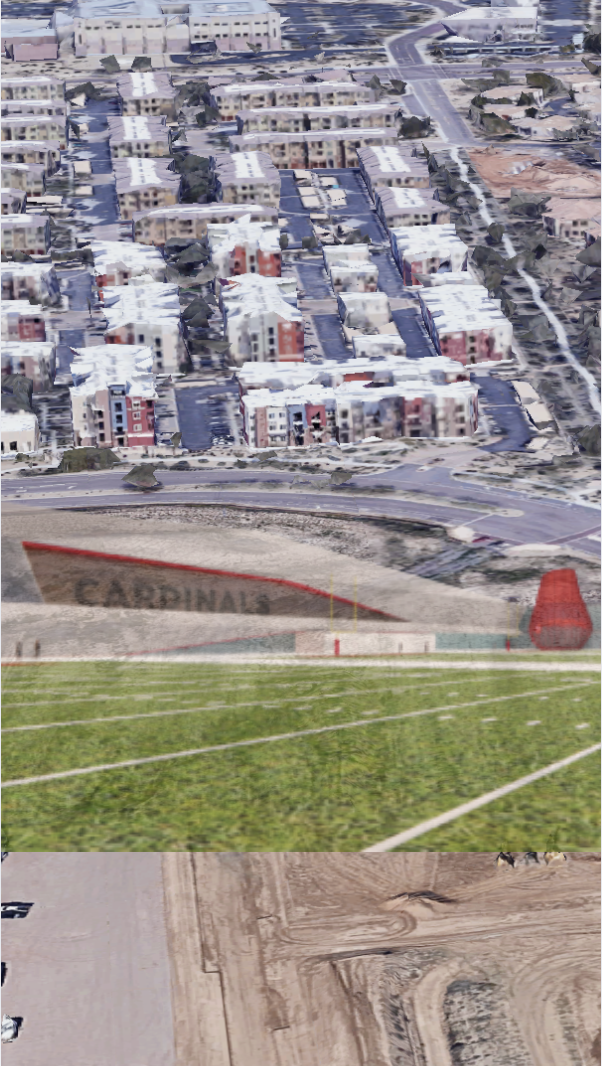

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

When the Desert Decides: How a Phoenix Dust Storm Grounded My Flight to CoronadoThis week, as I prepared to depart Phoenix Sky Harbor for Coronado Island, the Valley reminded me of its raw natural authority. What was meant to be a smooth evening departure turned into a 90-minute

When the Desert Decides: How a Phoenix Dust Storm Grounded My Flight to CoronadoThis week, as I prepared to depart Phoenix Sky Harbor for Coronado Island, the Valley reminded me of its raw natural authority. What was meant to be a smooth evening departure turned into a 90-minute Nice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.