Phoenix’s divergence suggests more resilient local fundamentals—migration, job growth, and supply constraints. Nationally, median home prices were down ~0.6 % and pending sales were collapsing ~31 %, indicating broader weakness. The relative strength tempers downside risk in Phoenix-centric holdings. From tax revenue projections, this resilience helps sustain municipal forecasts. Policymakers may point to this in justifying infrastructure or housing policy. For value stability, the local cushion provides greater breathing room than many other U.S. markets.

Phoenix’s Sol Modern tower at 50 East Fillmore Street—a 29‑story, ~332 ft high mixed‑use residential structure—is slated for completion in 2025, once finalized through design approvals.

Core residential portfolios can benefit high‑rise multifamily positioning. Property tax revenue and land value benefits are concentrated in midtown. Project moved under urban center overlay zoning. Vertical build supports scarcity value and future demand from downtown professionals. Amenity‑driven design features energy‑efficient systems, high‑density footprint and transit-proximity benefits.

Demolition of Metrocenter Mall began in November 2024 to make way for “The Metropolitan,” a $750 million transit‑oriented village including housing (1,200–2,000 units), retail and office on 68–80 acres adjacent to light-rail Metro Parkway station.

This generation of transit-linked real estate provides steady income streams, qualifies for TIF tools, and benefits institutional landlords. Rezoning facilitated vertical mixed‑use density. Future asset resilience is enhanced via multifamily + retail synergy; reduced carbon footprint via TOD design.

The new Greg Stanton Central Station, set to open in 2026, will anchor a 1‑million‑sq ft mixed‑use development featuring two residential towers—one will be Arizona’s second‑tallest—alongside retail, office and restaurant space.

Institutional-grade vertical residential adds depth to core portfolios. Transit‑adjacent property tax revenue and sales‑tax generation are expected to surge. This is enabled by council zoning and transport development financing frameworks. Transit‑oriented development supports future‑proof asset value; sustainability is reflected in reduced vehicle dependency and walkable design.

Opened in 2023 and expanded into 2025, the 17‑acre Culdesac Tempe neighborhood is the first fully car‑free U.S. residential project, housing ~200 residents in studios to three‑bedroom apartments ($1,300–2,900/month), with amenities including bike‑share, transit passes, plaza and micro‑retail managed by residents.

Portfolios focusing on innovation and ESG strategies track this as an emerging model. Tax contributions derive from property levy and local consumption. Local approvals supported novel zoning and parking regulation waivers. Future value is linked to shifting urban mobility preferences; sustainability is embedded via low‑carbon transit, dense land use and pedestrian infrastructure.

In mid‑2025, Thompson Thrift started the $225 million Gilmore development in Gilbert, which will deliver 300 luxury apartments, a hotel, and ~200,000 sq ft of grocery, boutique dining and retail on 35 acres.

Wealth‑management investors see long‑duration residential and hotel cash flows plus commercial diversification. Property and transient occupancy tax revenues benefit city budgets. Permitted through mixed‑use zoning approvals, the design aligns with adaptive reuse and modern urbanism. Blended tenancy enhances stability, and new units are built with sustainable materials and landscaping.

The $145 million Signature at SanTan Village retail development in Gilbert spans ~30 acres, featuring a 43,000 sq ft Whole Foods Market and a 119,000 sq ft DICK’S House of Sport with recreational offerings including golf simulators and climbing walls.

Institutional retail portfolios benefit from stabilized anchor tenancy and experiential traffic. Sales‑tax revenue is expected to rise due to high-income catchment demographics. Municipal zoning allows premium retail district development. Retail rents appear resilient even amid retail sector shifts, supporting future‑proof occupancy. The project incorporates open‑air design and energy‑efficient site planning, aligning with sustainable retail trends.

National manufacturing investment, including $65 billion in TSMC AZ fab construction, has catalyzed industrial property demand across Phoenix, drawing investors into warehouse, logistics, and supporting residential and hospitality compounds near these hubs.

Institutional portfolios anchored in sticky manufacturing ecosystems gain long‑term lease security. Tax revenues rise with industrial build‑out. Regulation includes federal and state incentives for advanced manufacturing. These assets are purpose‑built and highly future‑resilient. Sustainable design elements include EV charging and efficient layout.

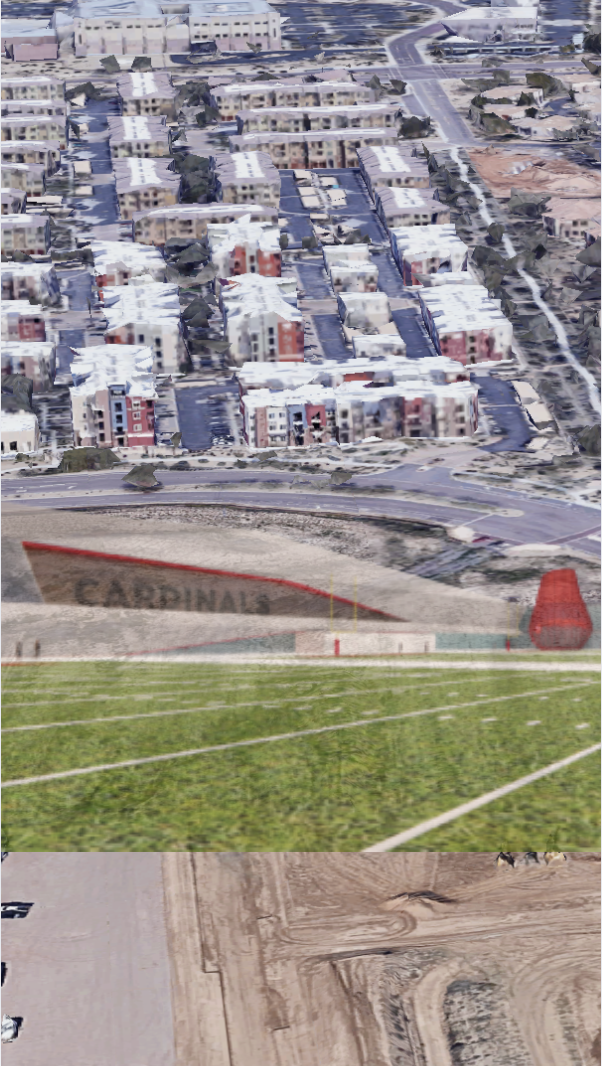

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Why Home Quality Can Vary Drastically Within The Same Community — And How To Protect Your InvestmentAcross Arizona’s fast-growing residential corridors, from North Scottsdale’s luxury enclaves to Mesa’s master-planned communities, buyers are finding an unexpected challenge: not all homes in the same

Why Home Quality Can Vary Drastically Within The Same Community — And How To Protect Your InvestmentAcross Arizona’s fast-growing residential corridors, from North Scottsdale’s luxury enclaves to Mesa’s master-planned communities, buyers are finding an unexpected challenge: not all homes in the same Seller’s Disclosures in Arizona Real Estate: What Buyers Need to KnowArizona’s housing market continues to see strong demand, with Maricopa County leading the nation in population growth and areas like Mesa, Queen Creek, and Peoria welcoming thousands of new residents

Seller’s Disclosures in Arizona Real Estate: What Buyers Need to KnowArizona’s housing market continues to see strong demand, with Maricopa County leading the nation in population growth and areas like Mesa, Queen Creek, and Peoria welcoming thousands of new residents  Exploring Arizona’s Unique Land Ownership Laws: What Every Future Homeowner, Investor, And Relocating Professional Needs To KnowArizona’s real estate market is unlike any other in the American Southwest. While rapid population growth and migration trends have made Phoenix, Scottsdale, Mesa, and Tucson some of the fastest

Exploring Arizona’s Unique Land Ownership Laws: What Every Future Homeowner, Investor, And Relocating Professional Needs To KnowArizona’s real estate market is unlike any other in the American Southwest. While rapid population growth and migration trends have made Phoenix, Scottsdale, Mesa, and Tucson some of the fastestNice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.