According to the IDC Worldwide Smart Cities Spending Guide, global spending on smart city technologies reached $189.5 billion in 2023 and is projected to exceed $250 billion by 2026. This investment is concentrated in sectors such as smart grids, intelligent transportation, and digital governance. For wealth management, such expansion underscores infrastructure as a resilient asset class with long-term appreciation potential. Tax frameworks increasingly accommodate incentives for sustainable and digital investments, while privacy rights and digital sovereignty are shaping policy. The scale of investment points to stability for real estate tied to smart infrastructure and sustainability-focused developments.

The downtown Phoenix footprint is being reshaped with multiple high-density residential towers combining amenity, retail, and office space. Many projects are scheduled to open in late 2025. This densification increases urban vitality, supports walkability, and leverages central infrastructure. For investors, premium downtown product may command higher rents and lower vacancy compared to peripheral markets. Permitting, height variances, and façade standards are material regulatory challenges. Municipal tax yield from increased density boosts revenue outlook. From a smart growth perspective, this encourages transit orientation, reduced sprawl, and efficient land use.

Phoenix’s divergence suggests more resilient local fundamentals—migration, job growth, and supply constraints. Nationally, median home prices were down ~0.6 % and pending sales were collapsing ~31 %, indicating broader weakness. The relative strength tempers downside risk in Phoenix-centric holdings. From tax revenue projections, this resilience helps sustain municipal forecasts. Policymakers may point to this in justifying infrastructure or housing policy. For value stability, the local cushion provides greater breathing room than many other U.S. markets.

The Mattel Adventure Park in Glendale, adjacent to the VAI Resort, blends immersive attractions tied to brands like Barbie and Hot Wheels. It represents a large experiential, tourism-driven real-estate anchor. Nearby hospitality, retail, entertainment real-estate may see uplift from increased visitation traffic. Local jurisdictions will face infrastructure demands (roads, parking, utilities). From a regulatory angle, permitting and event zoning will be important. In value terms, properties in surrounding districts may see revaluation linked to visitor amenities and foot traffic.

Under Phoenix’s Housing Phoenix Plan, the city has fast-tracked affordable housing and preservation efforts, having delivered or preserved more than 50,000 units—5,000 ahead of schedule. The current pipeline includes many “fully affordable” developments (not just mixed income). This scale matters for social stability, workforce housing, and mitigating extreme rent inflation. From a wealth management lens, affordable housing is lower yield but lower volatility. In the regulatory sphere, city incentives, density bonuses, or fee waivers often undergird such projects. In smart-city frameworks, affordability is integral to inclusive growth.

In recent weeks, Phoenix has seen its number of active listings rise markedly compared to prior quarters; concurrently, about 5.5 % of listings in a given week are undergoing price cuts. This dynamic signals softening seller leverage, particularly outside top-tier neighborhoods. For wealth holders, this underscores the need for granular underwriting. Municipal tax bases may feel pressure if downward adjustment persists. Regulators may reconsider permit timing incentives or relief. From a resilience lens, established, amenity-rich areas will remain comparatively stable.

Teravalis, a 33,800-acre development in Buckeye, envisions up to 100,000 homes and 55 million sq ft of commercial development but has only secured water for its first ~8,500 lots. State groundwater restrictions have paused approvals for many subdivisions. The stress underscores that future growth is increasingly tied to water allocations, regulatory approvals, and negotiations with tribal or utility authorities. For developers, water risk is now a core underwriting line. From a tax perspective, delayed buildout slows projected revenue. Regulatory frameworks may tighten further, and sustainable water innovations (reuse, desalination, leasing) become central for project viability.

Olea Scottsdale is being developed north of Loop 101 and east of Scottsdale Road, with careful setbacks (25 ft along main roads, 75 ft for townhouses) and desert landscaping buffers. The project is slated for phased completion through 2027. It targets high amenity, middensity multifamily + attached product in a premium suburban submarket. For real-estate investors, the scale and location may provide yield plus appreciation potential. Local jurisdictions will monitor infrastructure demand (roads, utilities) and traffic impact. The addition helps meet Scottsdale’s multifamily supply needs while aligning with sustainable growth patterns.

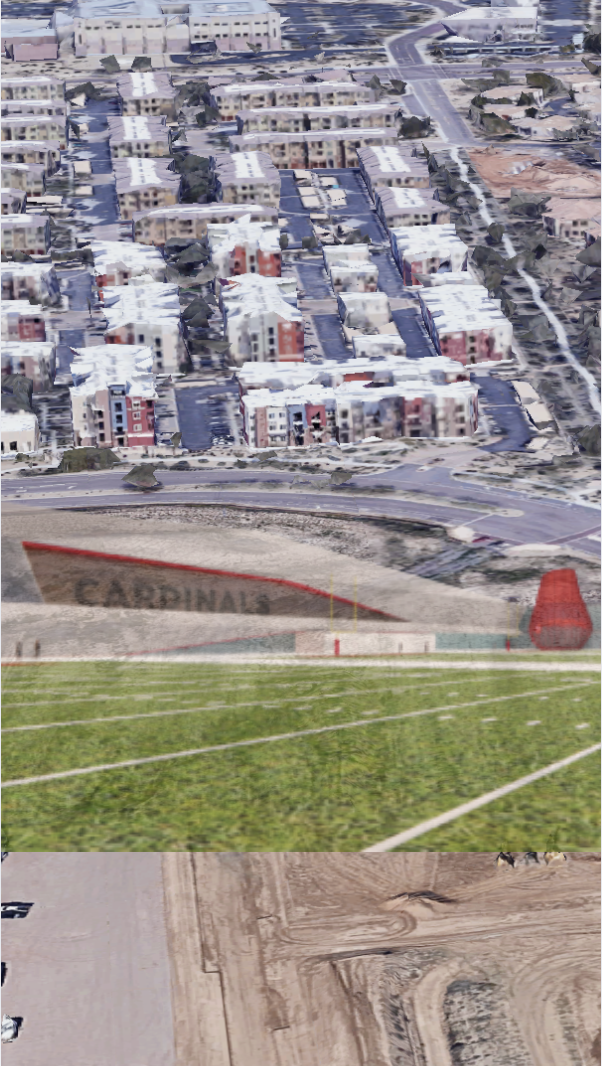

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028

Arizona Cardinals’ $136 Million “Headquarters Alley” Project: How a 217-Acre Deal Will Redefine North Phoenix by 2028 Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Public Safety as an Asset Class: The New Scottsdale AdvantageIn today’s Smart City economy, safety isn’t simply about peace of mind—it’s becoming a measurable, marketable asset class. Scottsdale is proving that public safety can be engineered into the fabric of

Loop 101’s Smart Expansion: How the Raintree Drive Interchange Is Shaping Scottsdale’s Next Mobility EraThe Loop 101 (Pima Freeway) corridor in north Scottsdale is undergoing one of its most consequential upgrades in years — widening from Princess Drive/Pima Road to Shea Boulevard and reworking

Loop 101’s Smart Expansion: How the Raintree Drive Interchange Is Shaping Scottsdale’s Next Mobility EraThe Loop 101 (Pima Freeway) corridor in north Scottsdale is undergoing one of its most consequential upgrades in years — widening from Princess Drive/Pima Road to Shea Boulevard and reworking  Why Home Quality Can Vary Drastically Within The Same Community — And How To Protect Your InvestmentAcross Arizona’s fast-growing residential corridors, from North Scottsdale’s luxury enclaves to Mesa’s master-planned communities, buyers are finding an unexpected challenge: not all homes in the same

Why Home Quality Can Vary Drastically Within The Same Community — And How To Protect Your InvestmentAcross Arizona’s fast-growing residential corridors, from North Scottsdale’s luxury enclaves to Mesa’s master-planned communities, buyers are finding an unexpected challenge: not all homes in the sameNice to meet you! I’m Katrina Golikova, and I believe you landed here for a reason.

I help my clients to reach their real estate goals through thriving creative solutions and love to share my knowledge.